- Events

- Virtual

Fixed Income Series

This educational course is designed for those seeking to gain a broader understanding of fixed income strategies. A sound understanding of fixed income markets and

CIO Investment Leadership Series Featuring Family Offices

The second installment of our CIO Investment Leadership Series will feature a diverse panel of Chief Investment Officer’s from leading family offices to discuss how

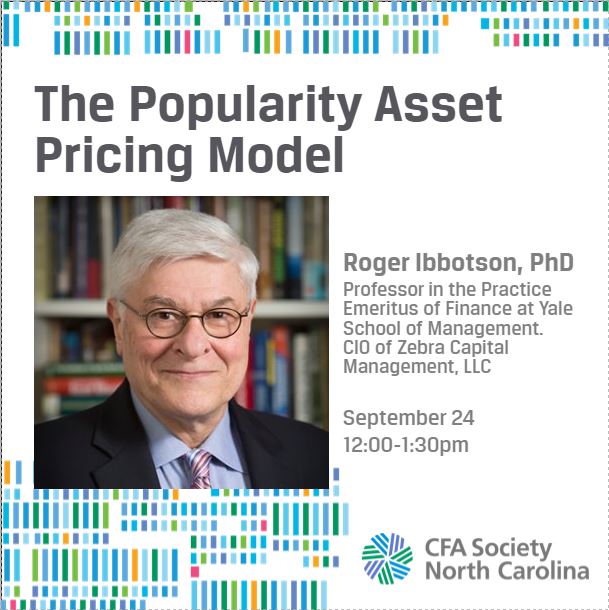

The Popularity Asset Pricing Model

The Popularity Asset Pricing ModelThe Popularity Asset Pricing Model (PAPM) builds on the familiar Capital Asset Pricing Model (CAPM) but relaxes key CAPM assumptions. In

TII Virtual Coffee-Break Series – Session #9: A Fireside Chat with Brady Dougan moderated by Ted Seides: From CS to FinTech to Investing in a Post-Covid World

Brady Dougan, the former CEO of Credit Suisse and now Founder of Exos Financial, will be interviewed by Ted Seides, Founder and Podcast Host of

CFA PROGRAM VIRTUAL OPEN HOUSE

Join us for a panel discussion on passing the CFA Exam during the COVID-19 Pandemic. Hear directly from the CFA Institute the latest updates on the

RESEARCH CHALLENGE KICK-OFF CALL

Join us to learn all you need to know about the 2021 CFA Institute Research Challenge.

CIO INVESTMENT LEADERSHIP SERIES FEATURING PENSIONS

The third installment of CFA Society Los Angeles’ CIO Investment Leadership Series will feature a diverse panel of Chief Investment Officers from leading Pensions to

A View from Washington: The Election + Life After COVID

Libby Cantrill is a managing director and head of public policy for PIMCO. In her role, she coordinates the firm’s response to public policy issues

Virtual Pumpkin Carving

Have you ever wondered how those incredible jack-o-lanterns get carved? Sean Fitzpatrick, a professional sculptor, will demonstrate how to create a pumpkin masterpiece! Don't miss

10 Ways to Ensure Your Job Search and Career Survives a Pandemic

In this webinar, Robert Hellmann of Hellmann Career Consulting will share with you the strategic and tactical advice he's giving concerned jobseekers and career advancers

Behavioral Insights From a Nobel Laureate: Dr. Richard Thaler, 2017 Nobel Prize winner for Economic Science, and Dr. Raife Giovinazzo, CFA, Partner, Lead Portfolio Manager at Fuller & Thaler Asset Management

Behavioral finance combines psychology and finance – contending thatpreconceptions and cognitive errors lead investors to misinterpret events andoverlook opportunities. People use shortcuts when making decisions

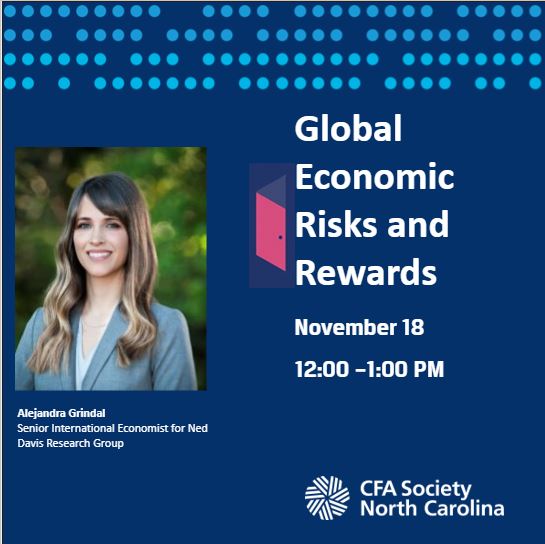

Global Economic Risks and Rewards

· Assessing the global business cycle and what the COVID-19 recession means for the economy and your investments. · In addition to the pandemic, what are the