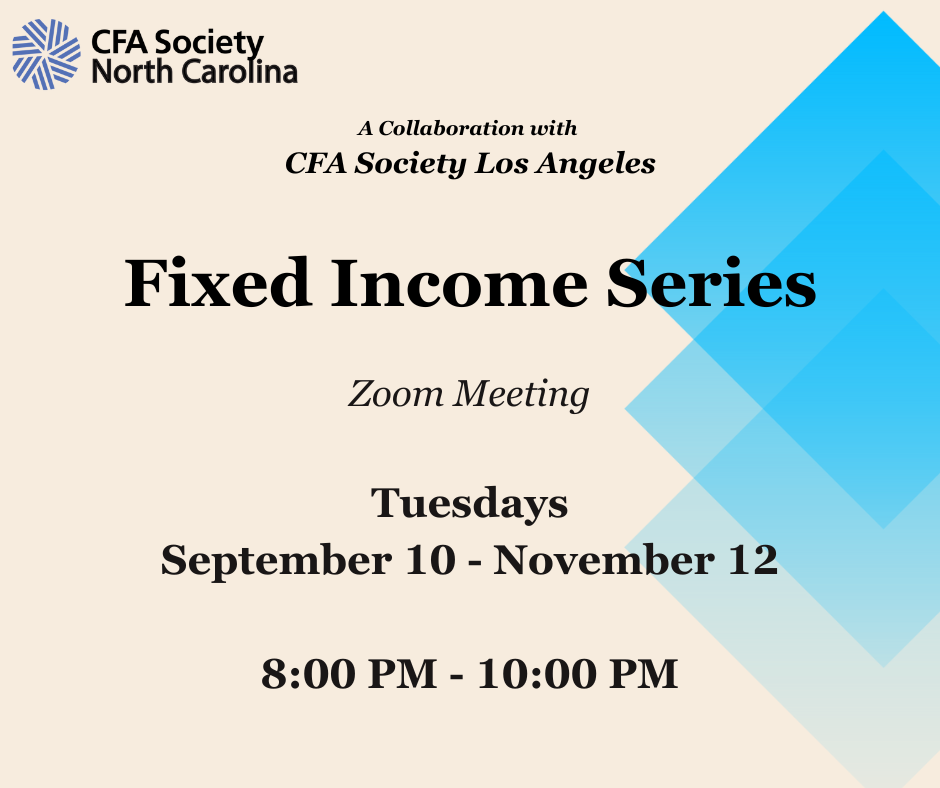

Fixed Income Series

This educational course is designed for those seeking to gain a broader understanding of fixed income strategies. A sound understanding of fixed income markets and

Webinar Series: A View on Washington & the State of the 2024 Election

Libby Cantrill | Ms. Cantrill is head of U.S. public policy and a managing director in PIMCO's portfolio management group. In her role, she analyzes policy

CLT-Is Private Credit a Bubble? Risks & Opportunities in Private Credit

Morton's the Steakhouse 227 W Trade St #150, Charlotte, NC, United StatesAs the clash between private lenders and the broadly syndicated market continues, the latter attempts to regain market share amid an attractive lending environment. In

Triad-Is Private Credit a Bubble? Risks & Opportunities in Private Credit

Forsyth Country Club Winston Salem, NC, United StatesAs the clash between private lenders and the broadly syndicated market continues, the latter attempts to regain market share amid an attractive lending environment. In

Triangle-Is Private Credit a Bubble? Risks & Opportunities in Private Credit

Flemings Steakhouse, Crabtree Valley Mall Glenwood Ave #5004, Raleigh, NC, United StatesAs the clash between private lenders and the broadly syndicated market continues, the latter attempts to regain market share amid an attractive lending environment. In

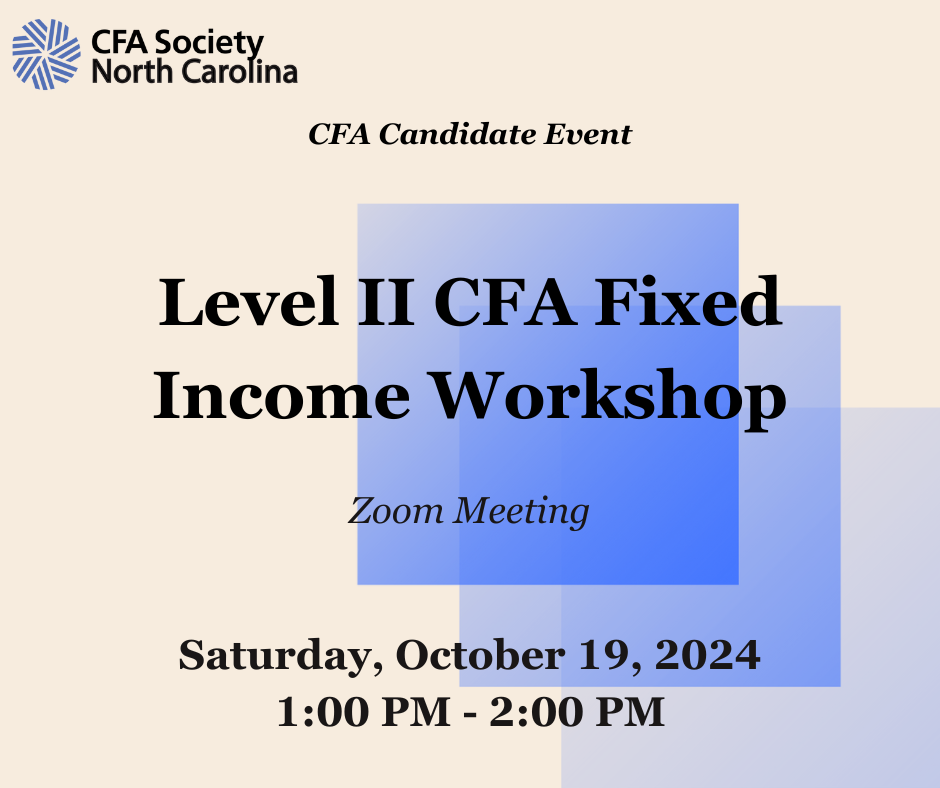

Level II Fixed Income Workshop

Are you ready for the Level II CFA Exam? How about the Fixed Income section? While Fixed Income at Level II is only 10% -

Triangle-Changing Behavior Using Behavioral Economics with Dan Ariely

Embassy Suites- RTP 201 Harrison Oaks Blvd, Cary, North CarolinaDan will discuss some of the challenges (and some of the benefits) of our irrationalities as they play out day-to-day in both the workplace and

CLT- Fireside Chat: Diversified Real Estate Discussion with John Ockerbloom, Head of U.S. and European Real Estate, Barings

Morton's the Steakhouse 227 W Trade St #150, Charlotte, NC, United StatesReal estate debt has grown increasingly as banks have reduced their lending activity. This fireside chat with John Ockerbloom will cover the residential space, commercial

Triad-Seizing the Moment: Exceptional Opportunities in Non-Core Real Estate Investing

Forsyth Country Club Winston Salem, NC, United StatesReal estate trades now seem to reflect higher interest rates and certain negative factors in general economies. Trading volume is still muted. It may take

Triangle-Seizing the Moment: Exceptional Opportunities in Non-Core Real Estate Investing

Flemings Steakhouse, Crabtree Valley Mall Glenwood Ave #5004, Raleigh, NC, United StatesReal estate trades now seem to reflect higher interest rates and certain negative factors in general economies. Trading volume is still muted. It may take

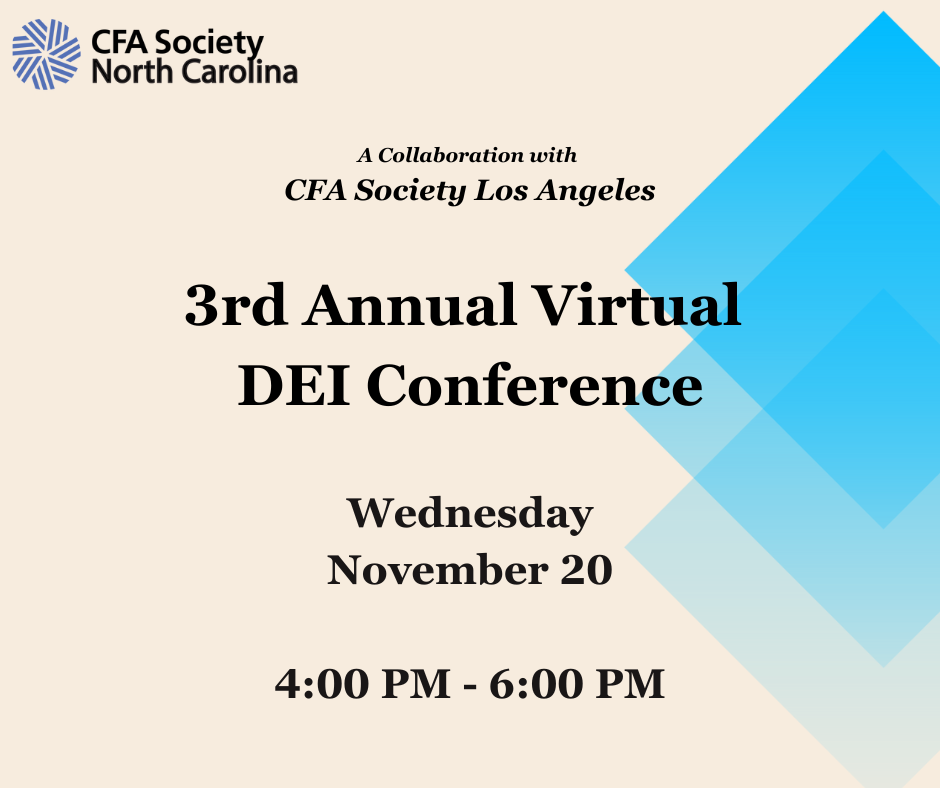

3rd Annual Virtual DEI Conference

CFALA and LACERA are happy to collaborate on our 3rd Annual DEI Virtual Conference. We will again briefly highlight CFA Institute’s DEI Initiatives and the

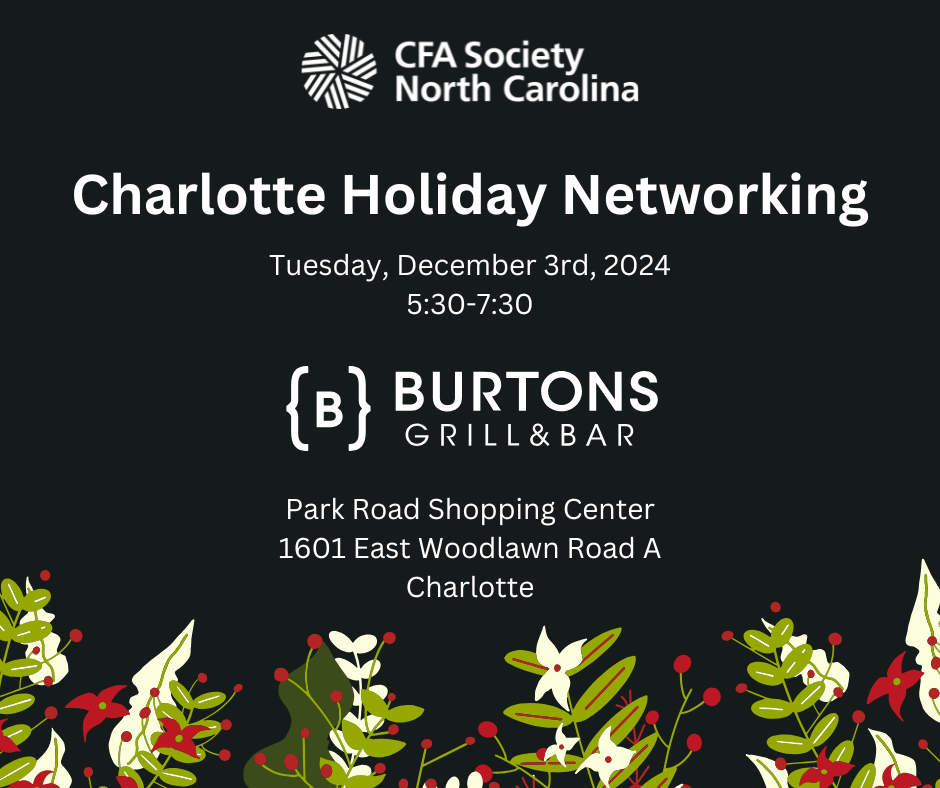

CLT-Holiday Networking: Burtons Grill and Bar

Burtons Gill & Bar 1601 East Woodlawn Road, CharlotteJoin us for an evening of festive cheer and professional connections at our Holiday Networking Event! Celebrate the season with colleagues, friends, and new connections