- Events

- Virtual

*Virtual-The Four Pillars of Post Covid Real Estate Investing

This presentation explores the main features and benefits of US and Global Listed Real Estate. The presentation also provides additional insight into the market and

Chinese Wealth Management Products, Safe as Cash

Do the benefits of investing in Wealth Management Products (WMPs) outweigh the benefits of simply holding cash? Hear from an expert panel in the CFA

Carbon Quotient: Building Accountability for Net Zero Across the Investment Value Chain

You’re invited to explore the development and the features of Carbon Quotient™ methodology with experts from accounting, institutional investors, and financial regulators. As a growing

Advanced SQL for Business and Finance

According to an MIT Technology Review article written by Antonio Regalado, the amount of digital data being created globally is doubling every two years. Yet only about 0.5%

Introduction to Business Analytics & Visualization with Power Bi

As enterprises continue to gather and collect oceans of structured and unstructured data given extremely cheap data storage options, there is a critical responsibility of business decision-makers

CFANY: Sixth Annual Global Macro Outlook

Recent changes to global monetary and fiscal policies are complicating the playing field for macro investors, who face difficult decisions as economies transition out of

Noise: Applications to Financial Analysis and Discussion of the Recent Book by Daniel Kahneman, Olivier Sibony, and Cass Sunstein

Daniel Kahneman is a winner of the 2002 Nobel Prize in Economics. His 2011 book Thinking, Fast and Slow is a seminal work in behavioral economics. Olivier

CFA Institute Research Challenge Kick-Off Call

On behalf of CFA Society North Carolina, we'd like to invite your school to find out about the CFA Institute Research Challenge. Like any great challenge,

Fintech Series-Investing in Private Companies: Valuations and Deal Flow

The supply of publicly trading company stock is only half what it was in 1980. High growth companies are delaying going public and many choose

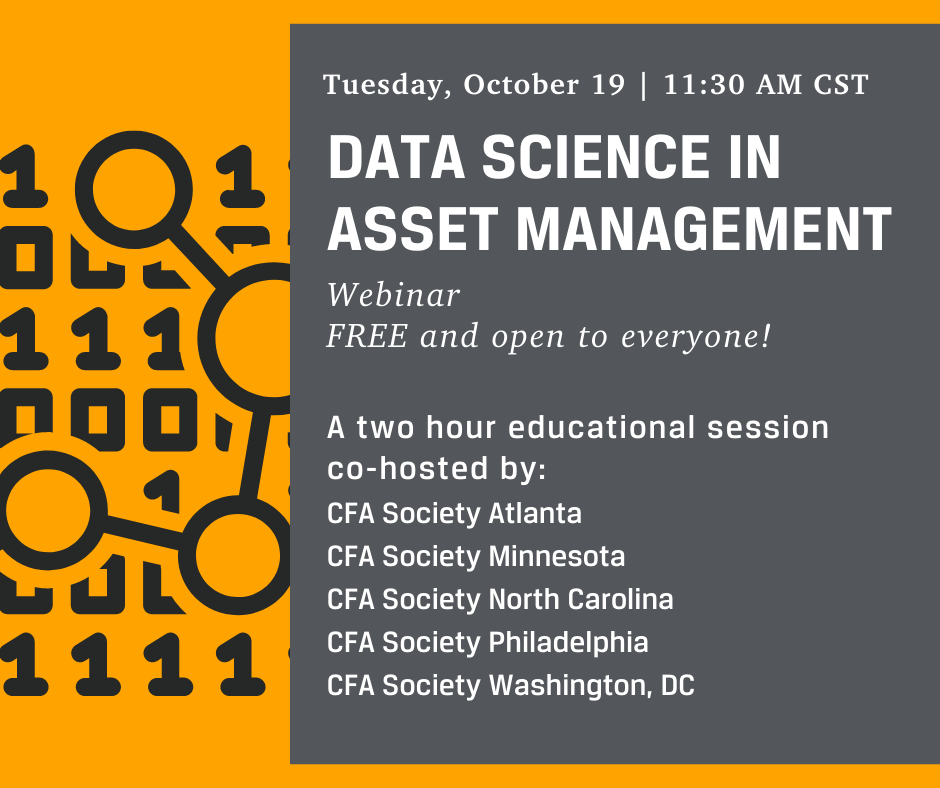

Data Science in Asset Management

Session I: Come learn how data science and machine learning are used in practice for asset management and forecasting from two practitioners in the field.

CFA Research Challenge-Company Follow Up Call

After watching ChannelAdvisor's Investor Day Webcast, join us to see your questions answered.

Portfolio Benefits of Fixed Income in a Low Yield Environment: A Quantitative Perspective

Extremely low interest rates have led some investors to consider a reduction in fixed income allocations in response to low prospective returns. Within fixed income,