CFA Exam Level III: Derivatives

If you’re preparing for the Level III CFA exam—and you want to better understand derivatives—you need to attend this webinar presented by Kaplan Schweser's David

Virtual-A Transforming World

We are at the dawn of a revolution. The pace at which technological and social megatrends are transforming our world today is unprecedented. However, we

Alternative Assets: Diversification w/ Asset Based Lending & Farmland/Timberland

Join us for an engaging conversation on how alternative asset classes can provide stability to portfolios in uncertain times through Private Credit and Real Assets.

Alternative Investment Series

This educational series is designed for those seeking to gain a broader understanding of alternative investment strategies. A sound understanding of alternative investments (AI) is

Sheila Bair Money Tales-a webinar for kids

CFA Institute is thrilled to bring a very special offering to our CFA Society members and their children in recognition of National Financial Literacy Month! Sheila Bair

Leveraging the Power of LinkedIn: Optimize Your Presence

Leverage the power of LinkedIn to build a community around your expertise and drive value to your business. In this workshop with a senior creator

Data Visualization and Business Analytics with Microsoft Power BI Training Course

Strong data culture is a sine qua non for effective organizations in the digital age, and proprietary data insights are increasingly becoming the most important

Introduction to Data Science for Finance

The amount of data available to organizations and individuals is unprecedented. Financial services sectors, including securities & investment services and banking, have the most digital

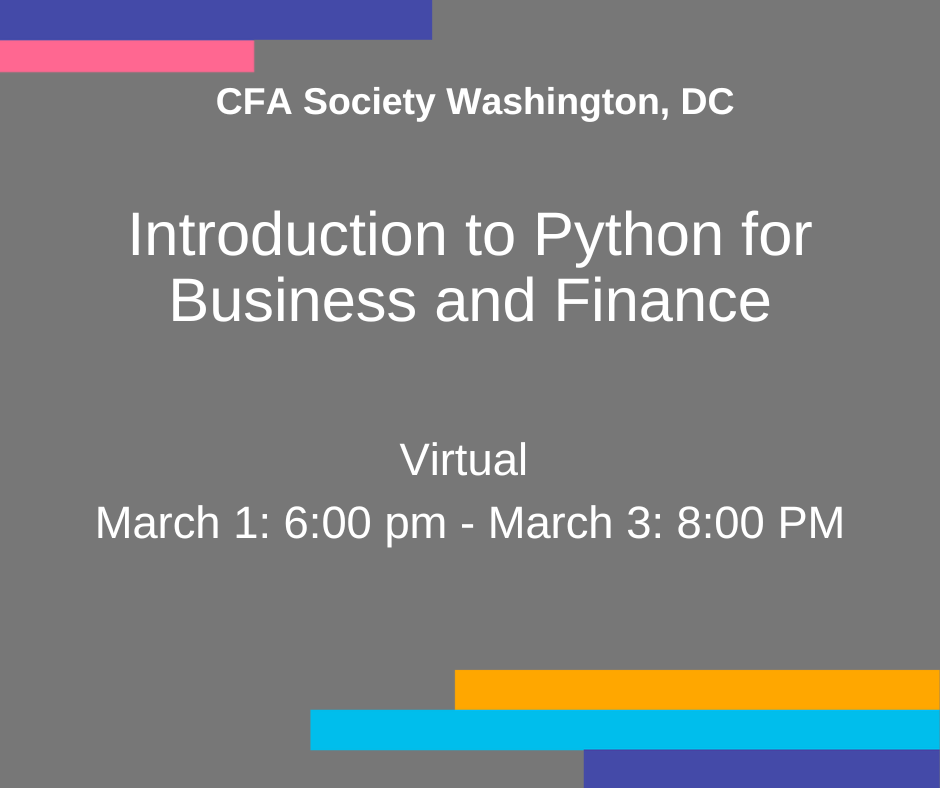

Introduction to Python for Business and Finance

Python is a high-level, object-oriented programming language that is used in a variety of projects ranging from data science and machine learning to backend web development.

Can Real Estate Weather Global Financial and Geopolitical Headwinds

A special invitation from our Annual Sponsor, Invesco In the words of the often-quoted Mark Twain “History never repeats itself, but it does often rhyme.”We

CEO’s Insights: Analyzing Global Earnings Calls at Big Data Scale

Investment decision makers are constantly on the lookout for an edge. Natural language processing (NLP) brings both scale and speed to investing. NLP techniques can

World Water Day: Investing in our Most Valuable Resource

Join us on World Water Day to hear experts discuss how investors can improve global water scarcity while positioning portfolios to benefit from attractive opportunities